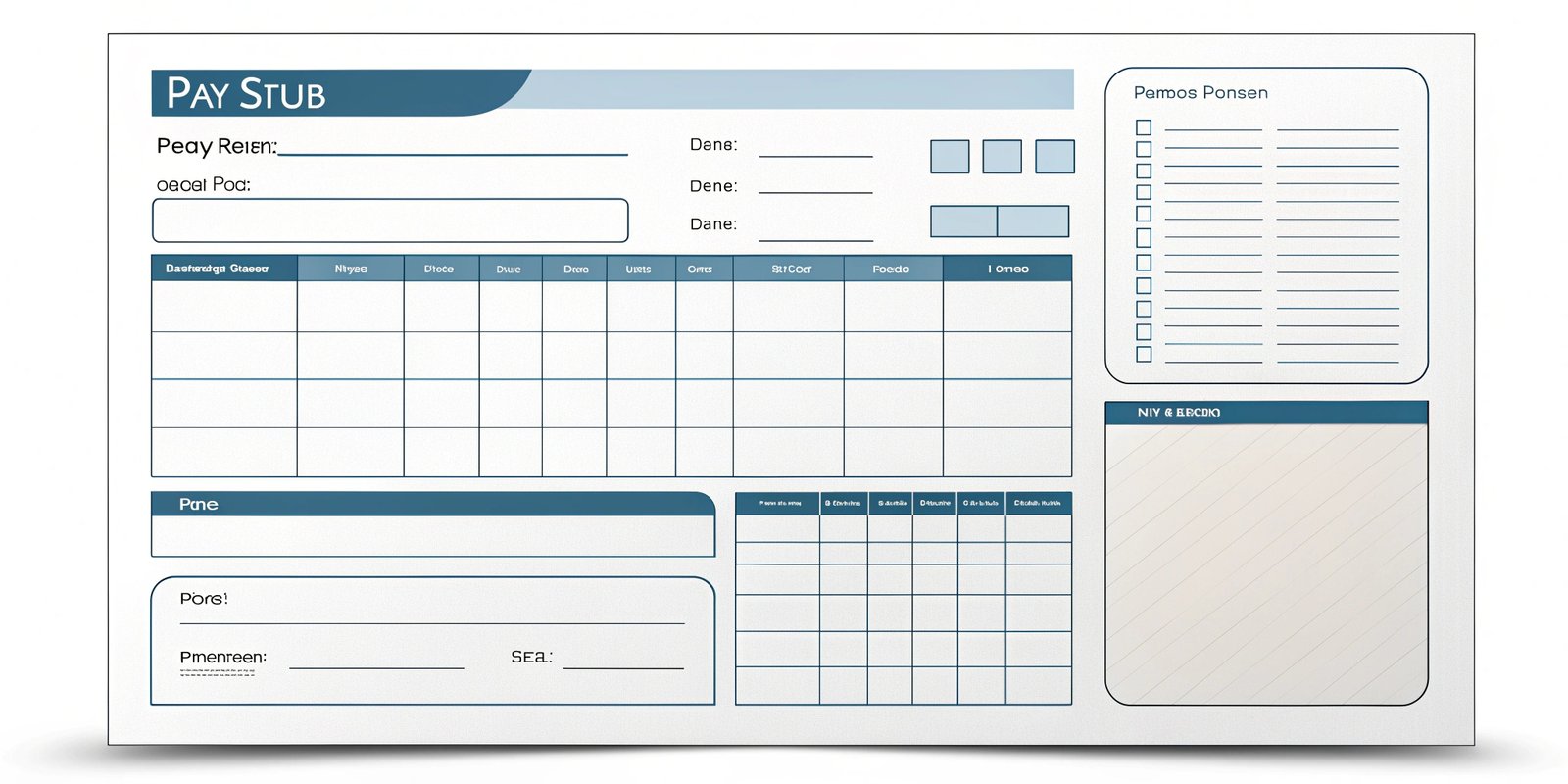

Fillable Free Pay Stub – PDF Templates

This document provides an overview of fillable, free pay stub PDF templates, their benefits, and where to find them. It also offers guidance on how to use these templates effectively and legally. These templates are useful for small business owners, independent contractors, and anyone needing to create professional-looking pay stubs without investing in expensive payroll software.

What is a Pay Stub?

A pay stub, also known as a paycheck stub or payslip, is a document that accompanies an employee’s paycheck. It provides a detailed breakdown of the employee’s earnings and deductions for a specific pay period. Key information typically included on a pay stub includes:

-

Employee Information: Name, address, and employee ID.

-

Employer Information: Company name and address.

-

Pay Period: The dates covered by the paycheck.

-

Gross Pay: Total earnings before any deductions.

-

Deductions: Taxes (federal, state, local), Social Security, Medicare, insurance premiums, retirement contributions, and other withholdings.

-

Net Pay: The amount the employee actually receives after all deductions.

-

Year-to-Date (YTD) Totals: Cumulative earnings and deductions for the current year.

Why Use a Fillable Pay Stub Template?

Using a fillable pay stub template offers several advantages:

-

Cost-Effective: Free templates eliminate the need for expensive payroll software, especially for small businesses or individuals with simple payroll needs.

-

Convenience: Fillable PDF templates are easy to use and can be completed on a computer or mobile device.

-

Professionalism: Templates provide a standardized and professional-looking format for Paystub Maker.

-

Customization: Many templates allow for some degree of customization, such as adding a company logo or specific deduction categories.

-

Record Keeping: Digital pay stubs can be easily stored and accessed for record-keeping purposes.

Where to Find Free Fillable Pay Stub Templates

Numerous websites offer free fillable pay stub templates. Here are some reputable sources:

-

Online Payroll Service Providers: Many online payroll services offer free templates as a lead-in to their paid services. Examples include Gusto, ADP, and Paychex. While they hope you’ll eventually subscribe, their free templates are often high-quality.

-

Business Resource Websites: Websites dedicated to providing resources for small businesses often offer free templates for various business needs, including pay stubs. Examples include SCORE and the Small Business Administration (SBA).

-

Template Websites: Websites specializing in templates for various documents often have a selection of free pay stub templates. Examples include Microsoft Office Templates and Canva.

-

Accounting Software Companies: Some accounting software companies offer free templates as part of their marketing efforts. Examples include QuickBooks and Xero.

When choosing a template, consider the following:

-

Ease of Use: The template should be easy to fill out and understand.

-

Completeness: The template should include all the necessary information required for a pay stub.

-

Customization Options: The template should allow for some degree of customization to fit your specific needs.

-

Reputation of the Source: Download templates from reputable sources to avoid malware or other security risks.

How to Use a Fillable Pay Stub Template

Using a fillable pay stub template is generally straightforward:

-

Download the Template: Download the PDF template from a reputable source.

-

Open the Template: Open the PDF file using a PDF reader such as Adobe Acrobat Reader (free).

-

Fill in the Information: Click on the fillable fields and enter the required information, such as employee details, employer details, pay period, earnings, and deductions.

-

Review the Information: Double-check all the information to ensure accuracy.

-

Save the Pay Stub: Save the completed pay stub as a PDF file.

-

Distribute the Pay Stub: Provide the pay stub to the employee, either electronically or in print.

Important Considerations

-

Accuracy: Ensure all information on the pay stub is accurate. Errors can lead to legal and financial issues.

-

Compliance: Comply with all applicable federal, state, and local laws regarding payroll and pay stubs.

-

Record Keeping: Maintain accurate records of all pay stubs for tax and legal purposes.

-

Security: Protect the privacy of employee information by storing pay stubs securely.

-

Professional Advice: Consult with a qualified accountant or payroll professional for guidance on payroll matters.

-

State Laws: Be aware that some states have specific requirements for pay stubs, such as including the number of hours worked or the employer’s FEIN. Ensure your template complies with these requirements.

-

Tax Withholding: Accurately calculate and withhold taxes based on employee W-4 forms and current tax laws.

-

Employee Classification: Correctly classify employees as either employees or independent contractors, as this affects tax withholding and other payroll obligations.

-

Backup: Always create a backup of your pay stub files to prevent data loss. Consider using cloud storage for added security.

-

Updates: Periodically check for updated versions of the template to ensure compliance with changing tax laws and regulations.

Alternatives to Fillable Pay Stub Templates

While fillable pay stub templates are a convenient option, other alternatives exist:

-

Payroll Software: Payroll software automates the payroll process and generates pay stubs automatically. This is a good option for businesses with more complex payroll needs.

-

Payroll Services: Payroll services handle all aspects of payroll, including calculating wages, withholding taxes, and generating pay stubs. This is a good option for businesses that want to outsource their payroll responsibilities.

-

Spreadsheet Programs: While not as professional-looking as dedicated templates, spreadsheet programs like Microsoft Excel or Google Sheets can be used to create custom pay stubs. This requires more manual setup and calculation.

Conclusion

Fillable free pay stub PDF templates offer a cost-effective and convenient solution for creating professional-looking pay stubs. By understanding the benefits, sources, and usage of these templates, individuals and small businesses can effectively manage their payroll needs. However, it’s crucial to prioritize accuracy, compliance, and security when using these templates. When in doubt, consult with a qualified professional for guidance.